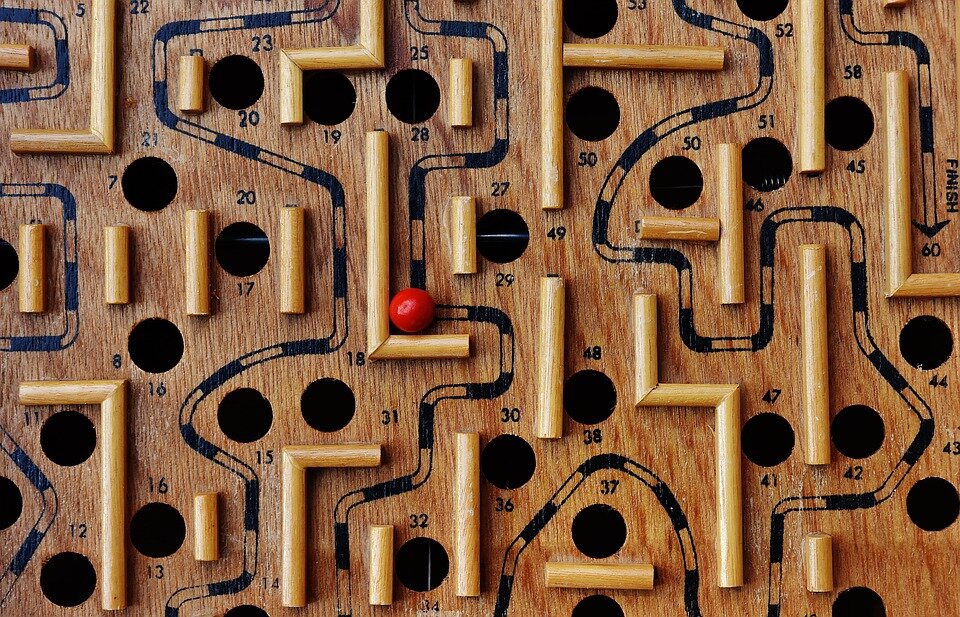

Medicare Appeals; A Labyrinth of Appeals

Medicare Advantage (MA) Plans (Part C) are growing quickly in the US. Of the 22 million Medicare beneficiaries in 2020, 34% are enrolled Medicare Advantage Plans and, according to the Kaiser Family Foundation, that percentage will rise to 47% in 2029. MA plans are run by private health insurance companies, many of which are large, for-profit entities.

Proponents of MA plans tout the convenience and choice of having one all-encompassing plan for health care coverage, despite limited provider networks and the imposition of clinical management on coverage decisions, which should remain solely within the sphere of the doctor-patient relationship. Critics of these plans have raised the alarm about the high levels of denials of coverage, which effectively are denials of actual care.

A 2018 report from the Dept. of Health & Human Services Office of Inspector General found “widespread and persistent problems related to denials of care and payment in Medicare Advantage” plans. When beneficiaries and providers appealed preauthorization and payment denials, Medicare Advantage Organizations (MAOs) overturned 75 percent of their own denials during 2014-16, overturning approximately 216,000 denials each year. “This is especially concerning because beneficiaries and providers rarely used the appeals process, which is designed to ensure access to care and payment. During 2014-16, beneficiaries and providers appealed only 1 percent of denials to the first level of appeal.”

The beneficiary appeals process mandated for MA plans consists of two levels of internal appeals, a third level at an outside Review Organization certified by Medicare, and a fourth (but not final) level with an Administrative Law Judge.

Beneficiaries usually arrive in my office at the third or fourth appeals level. I received three Administrative Law Judge (ALJ) appeals in 2019 from beneficiaries in MA plans. Two cases involved frail, elderly people who were in ‘short-term’ Skilled Nursing Facilities recovering from acute hospitalization and had been prescribed intensive rehabilitation therapy (Physical, Occupational, Speech) prior to discharge home. In each of these cases, a nurse case manager working for the MA plan improperly denied continued coverage of skilled rehabilitation services to these patients.

Each patient went through the mandated three levels of appeal, losing at each level, before coming to me for the ALJ appeal. From the initial denial of coverage through the ALJ decision, the approximate time in dispute was 2 years and 1 year, respectively. Each patient remained at the facility during the duration of the dispute, resisting payment of charges billed directly to them, and sometimes receiving the prescribed care, sometimes not.

The hearing preparation (about 20 hours per case) involved gathering clinical records, previous appeals records, the Medicare regulations and guidance manuals, writing an argument showing how the previous decisions were patently incorrect, and submitting all of this one month ahead of the hearing. All parties to the appeal received my documents.

At each hearing, before the Judge made his ruling, the MA plan representative conceded that the plan’s denial had been wrong and agreed to retroactively cover the care in question.

For those of us involved in work to prevent health disputes from escalating, these cases, and the many others I receive, are evidence of the discouraging reality presented in the OIG report; that too often, MA beneficiaries and their families are incorrectly denied coverage/care. And for the few who press on through the labyrinthine appeals process, the chance of success is increased, although at an inordinate cost to physical and mental health, and finances.